trust capital gains tax rate 2020 table

The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2021 to 2022 tax year. 10 and 20 tax rates for individuals not including residential property and carried interest.

The Tax Impact Of The Long Term Capital Gains Bump Zone

Add this to your taxable.

. Trust capital gains tax rate 2020 table Saturday March 19 2022 Edit. Based on the capital gains tax brackets listed earlier youll pay a 15 rate so the gain will add 300 to your tax bill for 2020. Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates.

Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. 2021 Long-Term Capital Gains Trust Tax Rates.

The Internal Revenue Service recently published its annual inflation-adjusted figures for 2020 for estate and trust income tax brackets as well as the exemption amounts. They would apply to the tax return. The following Capital Gains Tax rates apply.

With trust tax rates hitting 37 at only 12500 its not good to pay taxes out of a trust. It continues to be important. Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021.

Events that trigger a disposal include a sale donation exchange loss death and emigration. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed. Some or all net capital gain may be taxed at 0 if your taxable income is.

2020 Federal Income Tax Brackets and Rates. The tax rate on most net capital gain is no higher than 15 for most individuals. It continues to be important.

Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount. Additionally the 38 Obama-care surtax kicks in at that same top level. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

Capital Gain Tax Rates. By Soutry Smith Income Tax. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing. Its also worth noting that if youre on the cusp of. The following are some of the specific exclusions.

Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and. Irrevocable trusts are very different from revocable trusts in the way they are taxed. In 2020 to 2021 a trust has capital gains of 12000 and.

18 and 28 tax rates for individuals. First deduct the Capital Gains tax-free allowance from your taxable gain. The tax-free allowance for trusts is.

In 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Trusts and estates pay. Capital gains taxes on assets held for a year or less correspond to ordinary income tax.

An individual would have to make over 518500 in taxable income to be taxed at 37.

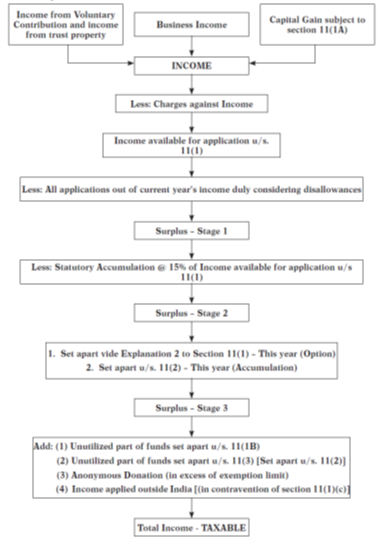

Trusts Ngos Scheme Of Taxation Computation Of Income Taxmann Blog

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition

How Are Capital Gains Taxed Tax Policy Center

Capital Gains Tax For Companies Part 3 Fincor

Trusts Ngos Scheme Of Taxation Computation Of Income Taxmann Blog

Irs Updates Estate And Trust Tax Brackets Exemptions Rates

2022 Capital Gains Tax Rates Federal And State The Motley Fool

Capital Gains Tax For Companies Part 3 Fincor

Do Irrevocable Trusts Pay The Capital Gains Tax

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

How Taxation Works For Aif And Pms Investors Capitalmind Better Investing

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

State Corporate Income Tax Rates And Brackets For 2020

An Overview Of Capital Gains Taxes Tax Foundation

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget